8 Easy Steps to Build Your Credit

6 Reasons Why you should build your credit fast

6 Reasons Why you should build your credit fast

1. Qualify for loans and credit cards:

Building credit increases the chances of getting approved for loans and credit cards when you need them. This includes big-ticket items like a car or a mortgage, or simply small loans and credit cards for everyday purchases.

2. Lower interest rates:

With good credit, you’re more likely to get approved for loans or credit cards with lower interest rates. This can save you money over time by reducing the amount of interest you pay on your debts.

3. Rental applications:

Building credit can make it easier to sign a lease for an apartment or rental home. Many landlords will check your credit history as part of the rental application process.

4. Employment:

Some employers may check credit history as part of the job application process, especially for positions that involve financial responsibilities.

5. Insurance rates:

Credit scores can be a factor in determining insurance rates for home, auto, and other types of insurance. Building good credit can help you receive lower insurance premiums.

6. Improve financial security:

Ultimately, building credit is about establishing financial stability. By demonstrating responsible credit use over time, you can build a solid credit rating that will help you navigate life’s ups and downs, from unexpected expenses and emergencies to planning for a secure financial future.

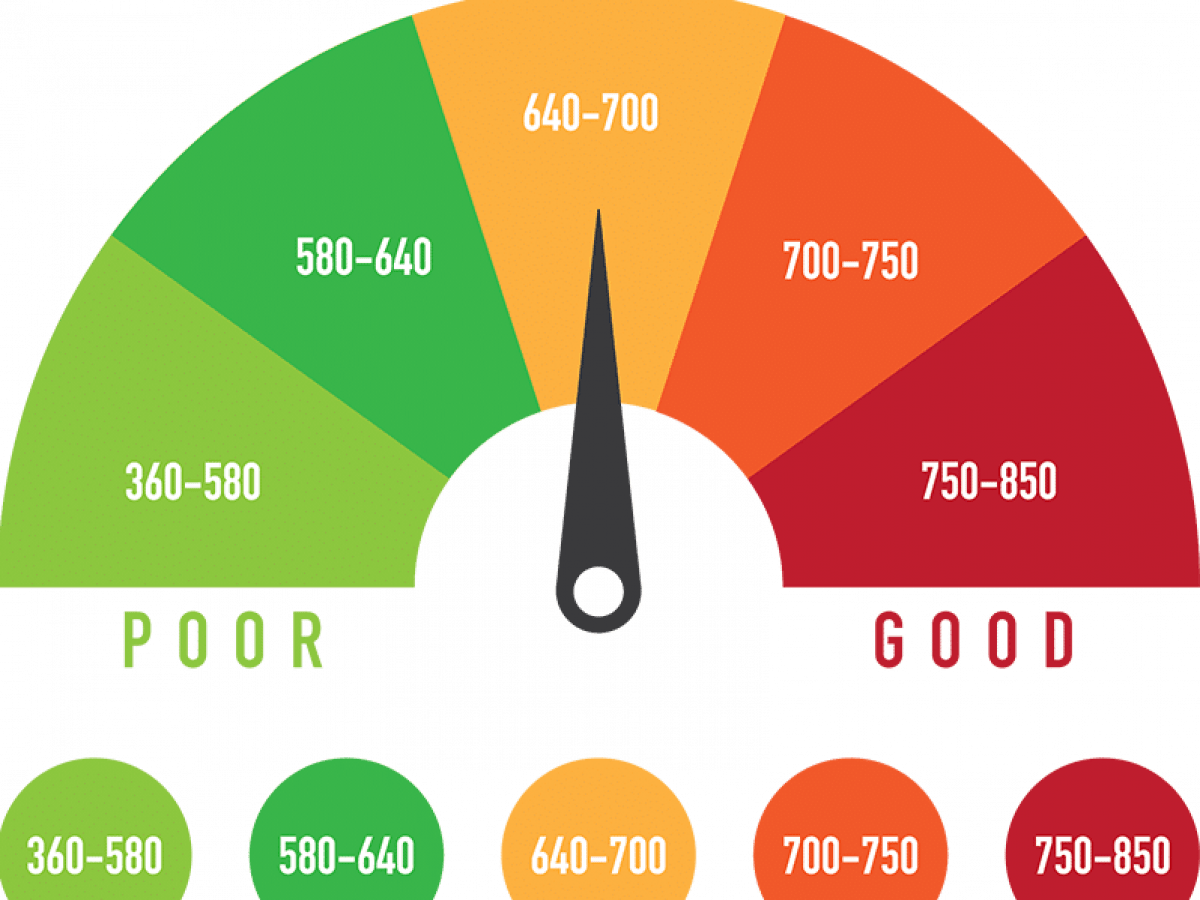

Here are some strategies to help you build good credit relatively quickly:

1. Obtain a secured credit card:

If you have limited or no credit history, getting a secured credit card can be a good starting point. Secured cards require a cash deposit as collateral, which becomes your credit limit. Make regular, on-time payments, and keep your credit utilization low (below 30% of your credit limit) to boost your credit score.

2. Make timely payments:

Pay all your bills, including credit cards, loans, and utilities, on time. Payment history is a crucial factor in determining your credit score. Late or missed payments can have a significant negative impact on your creditworthiness.

Set a reminder to pay your bills or set your payments to autopay.

3. Keep credit utilization low:

Credit utilization refers to the percentage of your available credit that you’re using. Aim to keep it below 30% to demonstrate responsible credit management.

For example, if your credit card has a $1,000 limit, try to keep your balance below $300.

4. Diversify your credit mix:

Having a mix of different types of credit, such as credit cards, loans, and a mortgage, can positively impact your credit score. However, only take on credit that you need and can manage responsibly.

5. Become an authorized user:

If a family member or friend with good credit is willing to add you as an authorized user on their credit card, it can help you build credit. The account’s positive payment history and age can be reflected on your credit report, but make sure the primary cardholder maintains responsible credit habits.

6. Monitor your credit report:

Regularly check your credit report for errors or discrepancies that could negatively impact your credit score. You’re entitled to a free credit report from each of the major credit bureaus (Equifax, Experian, and TransUnion) once a year.

Try Credit Karma – its free and they will tell you your credit usuage and monitor your payments

7. Avoid excessive credit applications:

Each time you apply for credit, a hard inquiry is placed on your credit report, which can temporarily lower your score. Apply for credit only when necessary and be selective about the applications you submit.

8. Be patient and consistent:

Building good credit takes time and requires consistent, responsible financial behavior. Focus on maintaining positive credit habits over the long term, and your credit score will gradually improve. The longer your history is with good credit the higher your score becomes.

Remember, building credit is a gradual process, and there are no quick fixes. Be cautious of any services or claims that promise to rapidly repair or rebuild your credit, as they often engage in unethical practices and may be scams. Building your credit now will help you get pre-approved for a house when the time is right and your finances are in order.