You may be unsure why it is important of getting pre-approved . Well, let me tell you, if you’re looking to buy a house, this is the first step. Thus, it’s essential to have a clear idea of your budget before you begin the house-hunting process. Getting pre-approved for a mortgage can be a helpful tool, giving you a firm understanding of what you can afford and allowing you to act quickly when you find the right property.

What is a pre-approval?

A mortgage pre-approval is written confirmation from a lender that you qualify for a mortgage up to a specific amount. To obtain a pre-approval, you’ll need to provide information to a lender about your financial situation, including your income, employment history, credit score, and debt.

A pre-approval is not a guarantee that you will be approved for a mortgage. The lender will need to verify your information when you apply for a mortgage formally. However, having a pre-approval from a lender can make you a more attractive buyer to sellers. It shows that you’re serious about buying a home and have taken steps to secure financing.

Why get pre-approved?

Why get pre-approved?

Getting pre-approved can provide you with several benefits, including:

1. Knowing your budget: A pre-approval can help you determine the maximum amount of money you can borrow and, subsequently, the price range of properties you can afford.

2. Streamlining the buying process: With a pre-approval, you can move quickly when you find the perfect home. You won’t have to wait for funding once your offer is accepted, as the pre-approval process has already been completed.

3. Negotiating power: A pre-approval can give you an advantage in a competitive market. If you’re pre-approved, sellers know you have financing in place, and you’re a serious buyer.

4. Identifying issues: If you’re not approved for a mortgage, a pre-approval will alert you to any potential issues in your credit or finances that need to be addressed before proceeding with the house hunt.

Overall, a pre-approval can save you time and stress in the home buying process and give you an idea of what price point you should be shopping at.

Steps to Getting Pre-approved

Getting pre-approved is a relatively straightforward process and typically involves four basic steps:

1. Selecting a lender: Start by researching lenders in your area and their mortgage products. You can talk to a mortgage broker who can work with multiple lenders as well.

2. Gathering your financial information: To apply for a pre-approval, you will need to provide the lender with key information about your financial situation. This information typically includes your income, employment history, credit score, and debt.

3. Completing a mortgage application: You will need to complete a mortgage application with your chosen lender. You can typically do this online or over the phone.

4. Getting pre-approved: This process can take anywhere from a few hours to several days, depending on the lender. Once the lender reviews your information and verifies your creditworthiness, they will provide you with a pre-approval letter detailing the maximum amount you can borrow, along with the terms of the mortgage.

What to look for in a pre-approval letter

When you receive your pre-approval letter, it will contain essential information about your loan and its terms, including the maximum amount you can borrow, the interest rate and the length of the mortgage (often 15 or 30 years). Review this letter carefully to ensure you understand the terms of the loan.

It’s also important to note that a pre-approval letter is not a guarantee of financing. Your mortgage still needs to go through the underwriting process once you have an accepted offer on a property.

Things to keep in mind with pre-approvals

While pre-approvals are a helpful tool in the home buying process, there are a few things to keep in mind:

1. Your pre-approved mortgage amount isn’t necessarily what you should spend. Just because the lender says you can borrow a specific amount doesn’t mean that you should. Consider other expenses like property taxes, insurance, maintenance, and repairs that add to the cost of owning a home.

2. A pre-approval doesn’t guarantee you’ll get a mortgage. While a pre-approval is helpful, it’s not a done deal. Your lender will still need to verify your financial information before approving your mortgage formally.

3. You can still shop around for a mortgage once pre-approved. Just because you’ve been pre-approved doesn’t mean that you can’t explore other options. You can still shop around for the best mortgage rates and terms once you’re ready to start the process in earnest.

Conclusion

If you’re in the market for a new home, it’s a good idea to get pre-approved for a mortgage. A pre-approval can provide you with a clear idea of your budget, streamline the buying process, and give you an advantage in a competitive market.

Talk to potential lenders to see who can offer the best terms and rates on your mortgage. Once pre-approved, you’ll want to weigh those offers against each other before selecting the one that works best for your financial situation and personal preferences. Don’t forget to get the free buyer’s guide to alert you about the other steps to buying a house.

Why get pre-approved?

Why get pre-approved?

Visit

Visit

2.

2.  3.

3.  4.

4.  5.

5.  6.

6.  7.

7.  8.

8.  9.

9.  10.

10.  11.

11.  12.

12.  13.

13.  14.

14.  15.

15.  16.

16.  17.

17.  18.

18.  19.

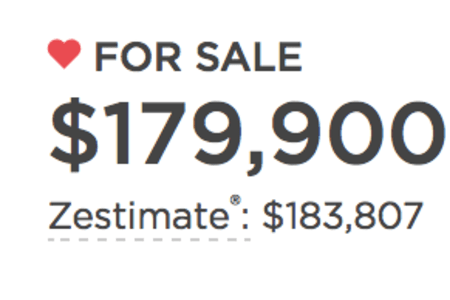

19.  20 Home Valuation Tool have Privacy concerns:

20 Home Valuation Tool have Privacy concerns:

When it comes to pricing your home for selling it, it is generally better to use the services of a real estate agent to get the most money. As a Real Estate agent, I have extensive knowledge and expertise in the local market, which allows me to provide an accurate estimate of what your home is worth.

When it comes to pricing your home for selling it, it is generally better to use the services of a real estate agent to get the most money. As a Real Estate agent, I have extensive knowledge and expertise in the local market, which allows me to provide an accurate estimate of what your home is worth.