Warning 20 Home Valuation Tool Shortcomings

The shortcomings are limitations of online home valuation tools, and it’s important for homeowners to understand these limitations when considering using them. Here are some warnings about the most common limits of online home evaluation tools:

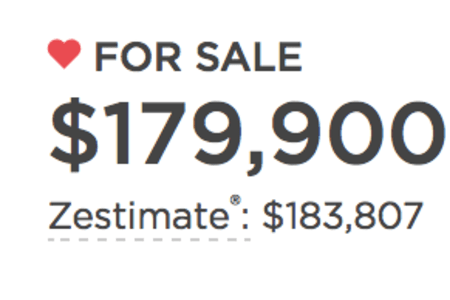

Warning! You Could Lose Money Trusting Online Home Valuation Tools

[rover_idx_home_worth]

Use the above quick home valuation tool to see what I mean. To get an accurate valuation, more information is needed.

1. Home Valuation Tools Only give Estimates:

Home Valuation Tools Only give Estimates:

Online home evaluation tools provide a rough estimate of a home’s value based on publicly available data and algorithms. They do not account for the unique features and characteristics of a home or the local market. As a result, they may provide a less accurate estimate of a home’s value.

2. Home Valuation Tools Lacks personalization:

2. Home Valuation Tools Lacks personalization:

Online home evaluation tools do not factor in the specific needs or preferences of a seller. They cannot provide personalized recommendations on how to improve a home’s value or how to best sell it.

3. Home Valuation Tools have Limited scope:

3. Home Valuation Tools have Limited scope:

Online home evaluation tools only consider data that is publicly available, such as recent sales data, tax assessments, and public records. They cannot account for off-market transactions or other factors that may impact a home’s value, such as neighborhood trends or future development.

4. Home Valuation Tools have Varying algorithms:

4. Home Valuation Tools have Varying algorithms:

Different online home evaluation tools may use different algorithms to calculate a home’s value, meaning that estimates from different tools may vary widely. This can lead to confusion and uncertainty for homeowners.

5. Home Valuation Tools have Legal concerns:

5. Home Valuation Tools have Legal concerns:

Depending on the state or country, some online home evaluation tools may not be legally allowed to provide home valuations or may be required to include disclaimers about their accuracy. Homeowners should be aware of these legal concerns before using online home evaluation tools.

6. Home Valuation Tools can provide Inaccurate data:

6. Home Valuation Tools can provide Inaccurate data:

Some online home evaluation tools may use incomplete or outdated public data, which can lead to inaccurate valuations. Additionally, they may not have access to information about recent renovations or upgrades that could positively impact the home’s value.

7. Home Valuation Tools have Limited market insights:

7. Home Valuation Tools have Limited market insights:

Online home evaluation tools may not consider the nuances of a local real estate market, such as fluctuations in buyer demand or recent changes in zoning laws. This limited view of the market can result in an inaccurate valuation that doesn’t reflect current market trends.

8. Home Valuation Tools are not inspected:

8. Home Valuation Tools are not inspected:

Online home evaluation tools cannot take into account the condition of a home, which is an important factor in determining its value. A home that’s in poor condition, for example, may have a lower value than a similar home that’s been well-maintained.

9. Home Valuation Tools give an Incomplete picture:

9. Home Valuation Tools give an Incomplete picture:

An online home valuation tool may not consider specific factors that influence the value of a home, such as the view, the quality of the neighborhood, or the style and age of the home.

10. Home Valuation Tools have Heavy reliance on data:

10. Home Valuation Tools have Heavy reliance on data:

While data is a key component of assessing a home’s value, online home evaluation tools may rely too heavily on data, without considering the intangible qualities of a home that can influence its value. Things like curb appeal, layout, and natural light are just a few examples of factors that data alone cannot accurately capture.

11. Home Valuation Tools Lack of context:

11. Home Valuation Tools Lack of context:

Online home evaluation tools do not provide context about the assumptions they make when generating a home valuation. For example, an online tool may assume certain market conditions or factors that are not immediately apparent to the user. This lack of context can result in an inaccurate valuation.

12. Home Valuation Tools have Limited flexibility:

12. Home Valuation Tools have Limited flexibility:

Online home evaluation tools may not provide the flexibility to adjust assumptions or input information that could affect a home’s value. This can result in an estimate that does not match the reality of the property or the market.

13. Home Valuation Tools contain Human error:

13. Home Valuation Tools contain Human error:

Online home evaluation tools rely on algorithms and technology to generate a home valuation, and as such, they are subject to the same potential for error as any other technology. Bugs, programming errors, or outdated data can all lead to inaccurate valuations.

14. Home Valuation Tools Lack of transparency:

14. Home Valuation Tools Lack of transparency:

Some online home evaluation tools may not provide transparent information about the data and assumptions they use to generate a home valuation. This lack of transparency can make it difficult for users to assess the accuracy of the estimate.

15. Home Valuation Tools have No negotiation:

15. Home Valuation Tools have No negotiation:

Online home evaluation tools do not factor in the potential for negotiation that may be present in a real estate transaction. This can lead to an overestimation or underestimation of a home’s value, depending on the goals of the buyer and seller.

16. Home Valuation Tools have Limited scope of data:

16. Home Valuation Tools have Limited scope of data:

Online home evaluation tools may only have access to data from a limited number of sources, which can limit the accuracy of the estimate. For example, they may only consider data from recent home sales, without factoring in other local factors that can affect home values, such as new developments, changes in zoning laws, or shifts in the local economy.

17. Home Valuation Tools have Limited local expertise:

17. Home Valuation Tools have Limited local expertise:

Some online home evaluation tools may not have access to local market experts, who can provide insights about the unique factors that influence home values in a specific area or neighborhood. This can limit their ability to provide accurate valuations for certain properties.

18. Home Valuation Tools are No substitute for professional advice:

18. Home Valuation Tools are No substitute for professional advice:

While online home valuation tools can provide a helpful starting point, they cannot replace the insights and expertise of a professional real estate agent or appraiser. Homeowners who are serious about selling their property should seek out professional advice to ensure they get the best possible price for their home.

19. Home Valuation Tools give Incomplete comparisons:

19. Home Valuation Tools give Incomplete comparisons:

To estimate the value of a home, online evaluation tools may compare it to other homes that have sold recently in the area. However, these comparisons may not take into account the specific features or characteristics of the home that make it unique. As a result, the estimate may be less accurate than if an appraiser or real estate agent had made the comparison.

20 Home Valuation Tool have Privacy concerns:

20 Home Valuation Tool have Privacy concerns:

Homeowners who rely on online home evaluation tools to estimate the value of their property may be required to provide personal information, such as their name, email address, or phone number. This information may be shared with third-party vendors or used for marketing purposes, which can be a concern for homeowners who value their privacy.

In summary, while online home evaluation tools can be a helpful resource for homeowners who are looking to get an estimate of their home’s value it is important to keep in mind their limitations. Homeowners who want a more accurate valuation or personalized advice on selling their property should consult a professional real estate agent or appraiser. Online home valuation tools can provide quick and easy estimates of a home’s value. Home owners should consider these limitations.

Homeowners should use these tools as a starting point as they explore their options for selling their home, and work with a real estate agent or professional to obtain a more accurate valuation. Overall, while online home evaluation tools can provide a helpful starting point for homeowners who are curious about their home’s value. It should not be relied on as the sole source of information. Homeowners should still seek the advice of a local real estate professional. Real Estate agents can provide a more personalized and accurate estimate of a home’s value based on the unique characteristics of the property and the local market.

Zillow.com, Redfin.com & Realtor.com are popular online Home Valuation Estimators, use with caution & only for General Estimation and understand their limits.

Get a No Obligation Home Evaluation from a Realtor

Read this article which compares Home Valuation Tools to Appraisals & Realtor’s CMA

https://lavillaproperties.com/what-is-my-home-worth/