Get a Cash Offer

Usually that reason is financial distress. Homeowners who are facing financial difficulties, such as mounting debts, mortgage arrears, or impending foreclosure, may need to sell their homes quickly to alleviate their financial burdens. In such cases, they may be willing to accept a lower price to secure a fast sale and obtain immediate cash. Another reason might be the need to relocate. Homeowners who need to relocate quickly, whether for job-related reasons, family emergencies, or personal circumstances, might prefer to sell their homes at a lower price to expedite the process. This allows them to access cash promptly and address their pressing needs or secure housing in their new location. There could also be property conditions inspiring them to consider getting a cash deal. If a property is in poor condition or requires significant repairs or renovations, homeowners may struggle to attract buyers who are willing to pay the full market value. In these situations, sellers might opt to lower the price to incentivize potential buyers and facilitate a quicker sale.

When its a seller’s market, it is more difficult to find sellers willing to take less, but poor market conditions can make homeowners feel pushed into a corner. In a buyer’s market where there is an abundance of properties for sale and limited buyer demand, homeowners may need to lower their asking price to compete with other listings. This strategy can help attract prospective buyers and expedite the sale process.

Please consult with me, your local Realtor to help see if this is the case. You may not need to under value your home. It is possible to get a fair price and sell quickly. Call (502) 417-3463 and speak to me for your urgent or important real estate needs. Let’s talk about your options.

Please consult with me, your local Realtor to help see if this is the case. You may not need to under value your home. It is possible to get a fair price and sell quickly. Call (502) 417-3463 and speak to me for your urgent or important real estate needs. Let’s talk about your options.

Another common reason people may consider selling quickly for less is because their property was gained by an inheritance or probate. This could feel like a be a win/win situation because the property was gained easily, but remember it is still your potential money you are willing to let go. In cases where homeowners inherit a property and are not interested in keeping it or managing its sale, they may choose to sell it quickly for cash, even if it means accepting a lower price. This allows them to convert the inherited property into liquid assets promptly. As your local Realtor, I am here to tell you “you don’t have to do it alone”. I have buyers & investors waiting for me to send them new listings. I can get your house the expose it needs for a quick sale. I also seen divorce or separation as another reason why homeowners choose this route. Homeowners going through a divorce or separation may decide to sell their shared property quickly to divide assets and move on. In these situations, a fast sale at a slightly reduced price might be preferred over the extended process of listing the property at market value.

There are many reasons to want to sell your home. Even people who are retired and downsizing often seek low cash deals to attempt to simplify their lives. I am a local Real Estate Agent and you don’t need to settle to have the issue of getting your house sold be a burden for you. I will help you through the entire process and do all I can do to allow you peace of mind and get your house sold without compromising your own children’s inheritance or your future security nest. You worked hard for your money, just because you are retiring or downsizing does mean you should sell fast, but this maybe the case for you. Thats ok, my buyers & investors are waiting to hear from me about new listings. Homeowners approaching retirement may choose to sell their homes at a lower price to downsize, reduce expenses, or free up equity for other purposes. The desire for a simplified lifestyle or the need to access cash for retirement plans can motivate them to accept a lower offer.

It’s important to note that the decision to sell a home for less than market value is a personal one, and homeowners should carefully consider their individual circumstances, financial needs, and long-term goals before pursuing such a sale. Consulting with me, as your local real estate professionals can provide valuable guidance in these situations.

You are not alone. CALL (502) 417-3463 or fill out the easy contact form below. Get your house listed for a quick sale today!

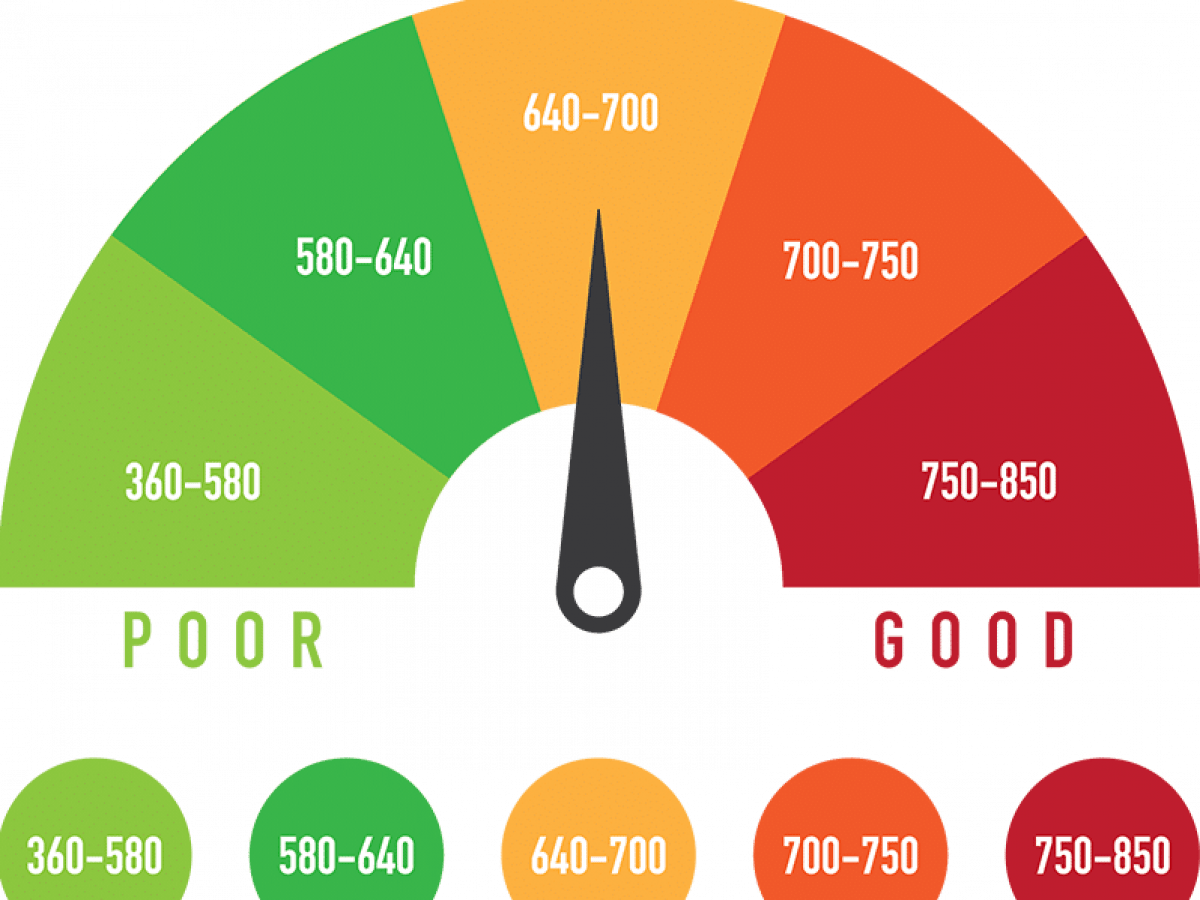

6 Reasons Why you should build your credit fast

6 Reasons Why you should build your credit fast

This website is new and I am currently adding my business contacts to it. Do you have another business? I want to network with you and share that business with my contacts. Please not, many of my contacts don’t own businesses and will just use my recommended service. Get your business listed on

This website is new and I am currently adding my business contacts to it. Do you have another business? I want to network with you and share that business with my contacts. Please not, many of my contacts don’t own businesses and will just use my recommended service. Get your business listed on