If you are a renter or live with someone who pays the cost of living, you might not be aware of the many benefits of homeownership. While there are many reasons why someone may choose not to buy or invest in real estate. You can find that article

here. There are more benefits to home ownership:

1. Building equity:

Unlike renters, homeowners pay a mortgage on a property that gradually decreases over time as they make payments. This builds equity in the property, meaning the value of the home is worth more than what they owe on the mortgage.

2. Tax benefits:

Homeowners can deduct mortgage interest and property taxes from their federal income taxes, which can result in significant savings.

3. Stability:

Owning a home provides a sense of stability and security, as homeowners can stay in their homes for as long as they want and make changes to the property without having to seek approval from a landlord.

4. Personalization:

Homeowners have the freedom to personalize their homes according to their personal style and preferences, which can be a significant advantage over renting.

5. Investment:

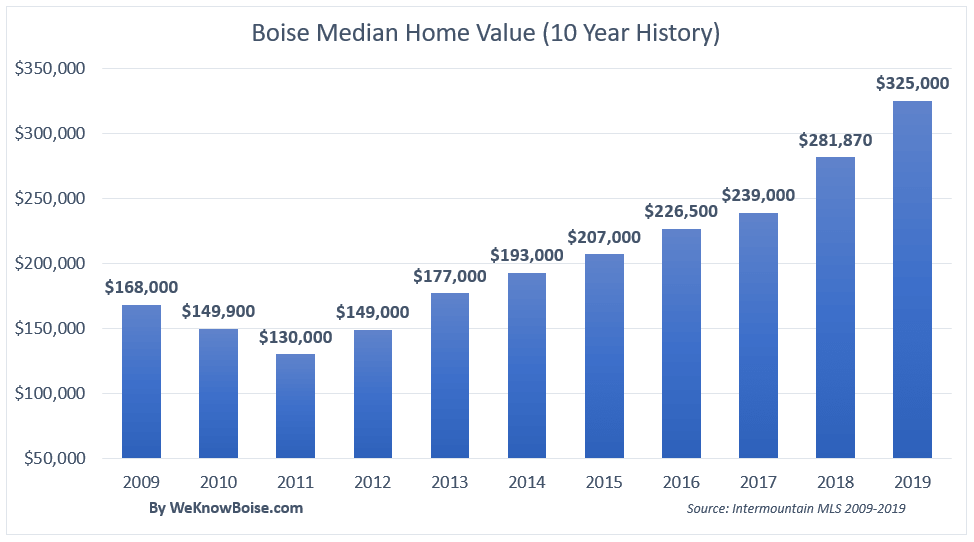

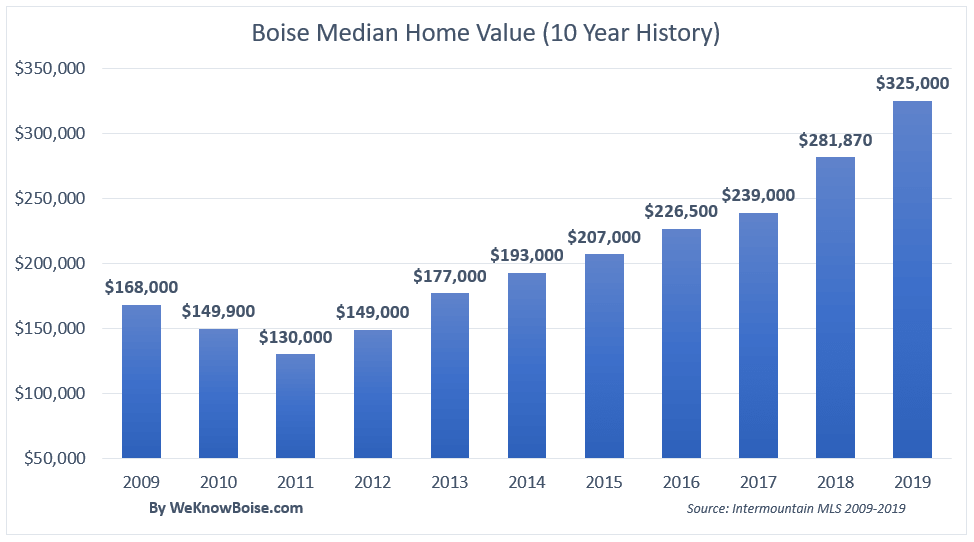

Buying a house can be a smart investment, as home prices tend to appreciate over time. Homeowners can sell their properties for a profit and use the proceeds to invest in other properties or assets.

6. Community:

Homeownership can help build a sense of community, as homeowners tend to be more invested in their neighborhoods and local schools.

7. Appreciation:

Homeowners can benefit from property appreciation, meaning the value of their home increases over time. This not only provides financial benefits but also increases their net worth.

8. Control:

Homeowners have control over their own property, meaning they can renovate, redecorate, remodel, and change the design to fit their preferences, lifestyle, and needs.

9. Privacy:

Owning a home provides more privacy than renting an apartment or house. Homeowners have their own space and usually don’t have to share walls or common areas with anyone else.

10. Pride of ownership:

Being a homeowner can be a source of pride and accomplishment, as it is a significant investment and achievement in life, as well as a place to call their own.

11. Freedom:

Homeownership provides the freedom to make decisions regarding their property without seeking the approval or permission of a landlord or property manager.

12. Predictable expenses:

Owning a home provides some predictability to expenses, as the mortgage payment and property taxes are usually fixed, and homeowners can better plan for their long-term financial goals and objectives.

13. Stability and roots:

Owning a home can provide a sense of stability and roots in a community. It may provide a sense of belonging and connection to the neighborhood and community.

14. Forced savings:

Paying a mortgage is a form of forced savings, as homeowners are building equity and wealth in their homes, which they can use as a source of future retirement income.

15. Pride of ownership:

Homeowners can take pride in their property’s appearance, upkeep, and maintenance, which can contribute to a sense of satisfaction and pride in their home.

16. Tax benefits:

Homeowners can, in some cases, deduct property taxes and mortgage interest from their federal income taxes, resulting in tax savings.

17. Better quality of life:

Homeownership can provide a better quality of life than renting, as owning a home provides more space, privacy, and control over the living environment.

18. Future rental income:

Homeowners can convert their homes into rental properties later in life and use the rental income to supplement their retirement income.

19. Generational wealth:

Owning a home and passing it down to future generations can provide wealth-building opportunities for succeeding generations, resulting in more long-term benefits.

20. Potential to generate passive income:

Homeowners can rent out a portion of their property or basement, for instance, for additional income, which can be used to supplement their primary source of income or pay down their mortgage.

21. Access to financial leverage:

Homeowners can access the equity in their home to borrow money for other investments or emergencies, which can provide a source of financial leverage.

22. Estate planning:

Homeowners can leverage estate planning strategies, such as gifting or transferring ownership of their home to family members, to minimize their estate taxes and preserve their wealth.

23. Better education opportunities:

Homeowners may choose to live in neighborhoods with the best schools, providing their children access to better education opportunities.

24. Increased social status:

Homeownership is often associated with higher social status and the perception of financial stability, which can be beneficial for both personal and professional endeavors.

25. Community involvement:

Homeownership provides an opportunity to be more involved in the community, as homeowners are more invested in the neighborhood and local issues.

26. Stability during retirement:

Owning a home can provide a sense of stability during retirement, as older adults often have lower incomes and fewer assets to rely on. A paid-off home can provide a sense of security, as homeowners do not have to worry about rent increases or eviction.

27. Home equity loans:

Homeowners can access home equity loans to pay for home renovations or emergency expenses, which can be more favorable than other forms of credit, such as credit cards, due to lower interest rates.

28. Long-term savings:

Homeownership is a long-term investment that can provide significant financial benefits in the long run. As the mortgage is paid down, homeowners build equity, which can be used for future investments or other needs.

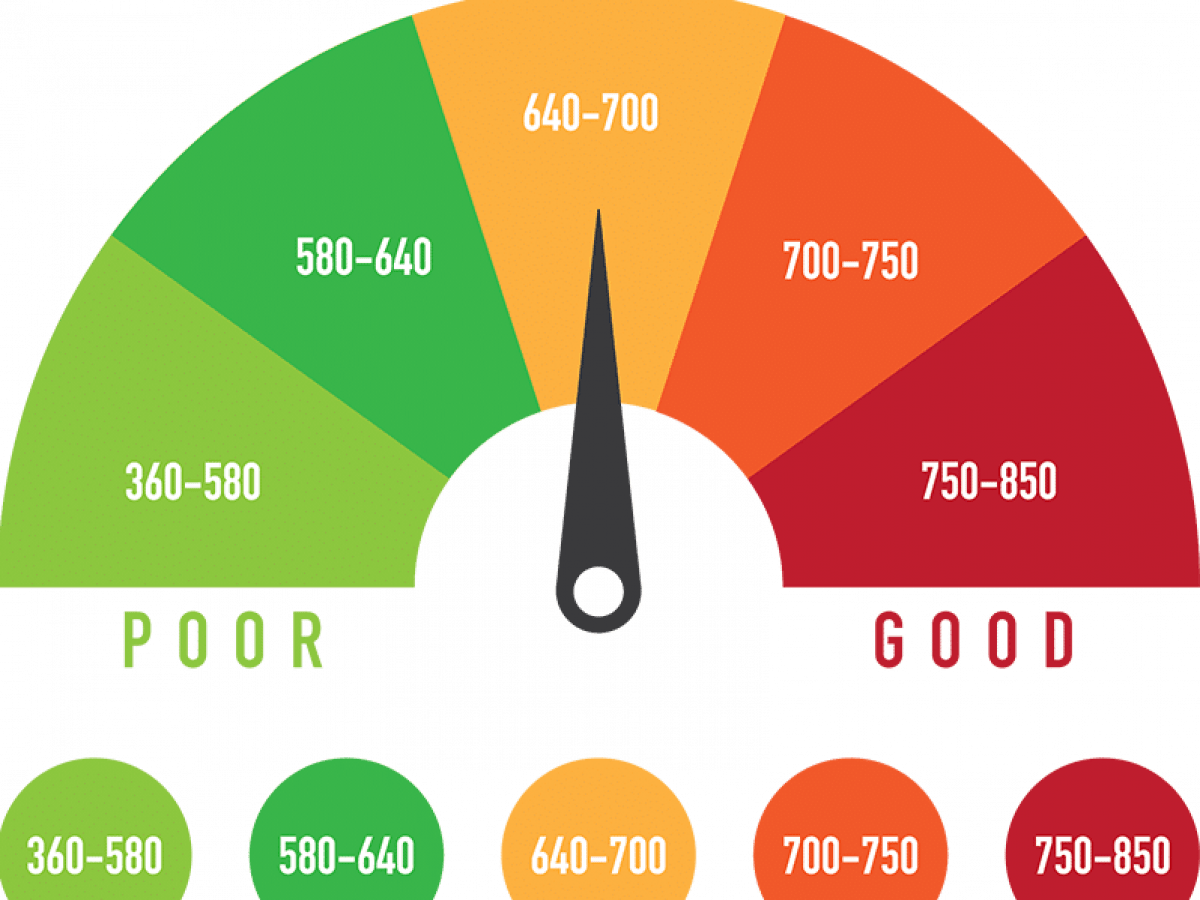

29. Better credit rating:

Homeownership can contribute positively to a homeowner’s credit rating, as they are considered a more secure borrower than renters.

30. Pride of community:

Owning a home can provide a sense of pride in the larger community, as homeowners often take pride in maintaining their properties and contributing to the overall aesthetic and value of the neighborhood.

31. Forced budgeting:

Paying a mortgage also forces homeowners to budget and prioritize their spending, which can lead to better financial habits and discipline.

32. Control over living space:

Homeowners have control over their living space, which means they can customize it based on their needs and preferences. They can renovate, remodel, or expand their homes without seeking the permission of a landlord. Homeowners can also have pets or larger families than they would be able to in a rental property.

33. Potential rental income:

Homeowners can use their property as a rental property, which can provide an additional source of income. Homeowners can rent out an entire property or just a room, providing a way to supplement their income.

34. Better health outcomes:

Studies have shown that homeownership is linked to better health outcomes, such as lower rates of depression, obesity, and asthma. Homeowners typically have better access to safe housing, green spaces, and other amenities that can contribute to their physical and mental health.

35. Legacy building:

Homeownership can provide a way to build a legacy and pass on assets to future generations. Homeowners can use their property as a way to build wealth and create financial stability for their families and future generations.

36. Forced savings:

Paying down a mortgage is a form of forced savings, as every payment made goes towards building equity in the property. This can help homeowners accumulate wealth over time, even if they don’t actively save money.

37. Predictable housing costs:

Homeowners with a fixed-rate mortgage have predictable housing costs, as their monthly mortgage payment will remain the same for the entire term of the loan. Unlike renters, homeowners with a fixed-rate mortgage won’t have to worry about rent increases or unexpected fees.

38. Improved credit score:

Making regular, on-time mortgage payments can help improve a homeowner’s credit score over time, making it easier to qualify for future loans and credit cards.

39. Sense of community:

Homeowners often have a greater sense of community than renters, as they tend to stay in their homes longer and become more involved in their neighborhoods. This can provide a greater sense of belonging and social support.

40. Financial stability:

Homeownership can provide financial stability, as homeowners have a valuable asset that can appreciate over time. This can provide a sense of security and peace of mind, especially during times of economic uncertainty.

41. Greater privacy:

Homeowners have greater privacy than renters because they don’t have to share their living spaces with others. They can also install security systems and fencing to make their homes more secure.

42. Sense of community:

Homeownership can lead to a sense of community. Homeowners may be more likely than renters to become involved with local groups or social clubs in their neighborhoods, leading to a sense of belonging and stronger social networks.

43. Improved quality of life:

Homeownership can lead to an improved quality of life because homeowners have greater control over their living environments, can customize their homes according to their needs, and can experience greater stability in their housing situations.

44. Long-term investment:

Homeownership is a long-term investment that can pay dividends over time. Owning a home allows homeowners to build wealth and equity over time, as well as take advantage of appreciation, which can lead to financial security later in life.

45. Personal satisfaction:

Owning a home can provide personal satisfaction and a sense of accomplishment. Homeowners are often proud of their properties and enjoy being able to personalize their homes to their liking.

These are just some of the many benefits of being a Homeowner. Are you missing out?

Give me a call & I can help you get there. (502) 417-3463

I working on building relationships & networking. It is a lot of work to build a first time buyer to get them ready to buy, but I see the value in working with you if this is you. I hope to earn your business. Don’t be shy, give me a call!

Why get pre-approved?

Why get pre-approved?

2.

2.  3.

3.  4.

4.  5.

5.  6.

6.  7.

7.  8.

8.  9.

9.  10.

10.  11.

11.  12.

12.  13.

13.  14.

14.  15.

15.  16.

16.  17.

17.  18.

18.  19.

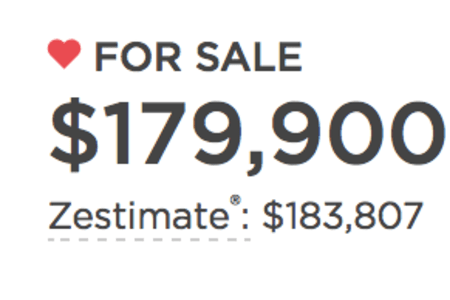

19.  20 Home Valuation Tool have Privacy concerns:

20 Home Valuation Tool have Privacy concerns:

6 Reasons Why you should build your credit fast

6 Reasons Why you should build your credit fast